Why Should Employers Be Aware of Their Employees Retirement Plan?

October 30, 2015

MID-MICHIGAN FIRM STAKES CLAIM AMONG COUNTRY'S ELITE

Headquartered in Linden, Michigan,

Innovative Retirement Solutions is one of very few financial services

firms dedicated exclusively to workplace retirement plans. With no product

affiliation, Innovative Retirement Solutions not only reinvented the

relationship between employer and advisor, but also did soby word of

mouth, with no product sales or hidden revenue.

Keith graduated from Grand Blanc High School and went onto receive a Bachelor of Science in Finance from Michigan State University. As most young graduates do, Keith decided to move away and ended up landing a job in Troy at an insurance firm. Keith immediately recognized they had a gap in their service portfolio and spearheaded the development of their 401k program.

In 1993, Keith decided to start his own business, in 1999 he took over management of a 17-advisor firm in Farmington Hills and in 2006 when he had started his own family he realized he wanted to move back home to Genesee County.

“I wanted to move back home to be near our immediate and extended family. I also wanted to be close to the kids schools so I could be part of all their important events.” Keith explained. “I never miss an event, whether it be to chaperone on a field trip, classroom party, dance recital, cheer competition or baseball game.”

Keith graduated from Grand Blanc High School and went onto receive a Bachelor of Science in Finance from Michigan State University. As most young graduates do, Keith decided to move away and ended up landing a job in Troy at an insurance firm. Keith immediately recognized they had a gap in their service portfolio and spearheaded the development of their 401k program.

In 1993, Keith decided to start his own business, in 1999 he took over management of a 17-advisor firm in Farmington Hills and in 2006 when he had started his own family he realized he wanted to move back home to Genesee County.

“I wanted to move back home to be near our immediate and extended family. I also wanted to be close to the kids schools so I could be part of all their important events.” Keith explained. “I never miss an event, whether it be to chaperone on a field trip, classroom party, dance recital, cheer competition or baseball game.”

The dedication Keith gives to his family is also a consistent theme in his business and his community. Keith served as the 2014 Chairman of the Board for the Fenton Regional Chamber of Commerce and has also been part of the growing development in Fenton and Linden. When Ed Koledo, superintendent of the Linden Community Schools and Chamber Board member, suggested bringing a Gus Macker to Linden, Keith was on board and served on the leadership committee for the Gus Macker event. “I like the fact that Genesee County is a slower pace compared to the Detroit suburbs and it also allows me to build relationships with the schools and community leaders.”

Keith is the Lead Business facilitator for the Fenton Regional Chamber program, Boys and Business, which is an entrepreneurial workshop for local area high school juniors and seniors. He is also the chair of the Business Development committee working to help create services in the chamber that local businesses can utilize.

All of these community events Keith is involved in has allowed him to create professional relationships with local companies that respect and understand Keith’s way of doing business.

“100% of my business is solely based on referrals,” Keith explained. “We do things a little differently than some of our competitors and our clients really appreciate that. This has allowed Innovative Retirement Solutions to grow through word of mouth.”

The industry is ever changing and Keith was one of the first advisors to go fee based 15 years ago. He also has the ability to communicate the plan with the investor, controller and trustees of the company before he educates and assists in enrolling the participants. Keith has the ability to identify plan expenses and offer ways to manage them without making sacrifices to the plan. Often times it’s not the plan provider that needs to be changed, it’s the fund options, expenses and education of the participants that will lead to greater participation and a successful plan.

“When I started 25 years ago the big question everyone wanted to know was if you had an 800 number and if they could add an investment account,” Keith stated. “Today the definition of a good 401k plan is measured by the amount of how many participants are on track to retire. So this is

what we focus on for our clients.” Evolving out of a larger corporate structure, Innovative Retirement Solutions has the in-depth industry experience of a large established firm but without the inherent conflicts of interest that plague most firms. This conflict free business model has led to rapid company growth. Some additional factors that have led to the rapid growth of Innovative Retirement Solutions unique approach include:

• White House and Department of Labor consideration of new fiduciary rules;

• Growing complexity around the administration of Corporate Retirement Plans;

• Increased appetite for conflict-free, customized retirement plans;

• Offering the clearest Fee Disclosure documents;

• Early adoption of sophisticated new technologies that increase service;

• Not accepting hidden revenue, at a time when employers have to answer for it; and,

• Newer, complex types of retirement plan design features coming to smaller employers.

Innovative Retirement Solutions has clients with branches or offices all over the country, and because their goal is to educate every employee on their retirement plan options, they travel to the different branches to meet with the individual participants.

A well-known car dealership in Fenton is one of their local clients and a team member from Innovative Retirement Solutions is there when the have a new hire orientation or have someone with questions about their 401k plan. Since Innovative Retirement has taken over the plan with this car dealer, they were able to grow the plan participants from 20 to 65 people in the first year.

“The biggest asset of any business owner is their business. Business owners can’t afford to have employees who are not on track to retire. I show my clients a different perspective of what not having a good 401k plan for their employees could look like. Having a 401k strategic plan to bring in knowledgeable and good employees ultimately benefits all parties.” Keith explained.

Proposed new government legislation could potentially mandate employers to have a 401k plan available for their employees. Employers could be liable and exposed to litigation if they have employees who are eligible for retiring and there was a 401k plan available, but the employees were never educated about the plan.

“We make a point to ensure every employee is educated.”

Keith shared that during the education process the number one question from every employee is ‘How much money do I need to retire?’ As part of their Work Site Financial Solutions program, LPL has programs in place which assists the participants with a multitude of things from assisting with rollovers from previous employers, advice on investments, creating retirement goals and strategic planning.

The biggest advantage Innovative Retirement Solutions has is that they are completely independent. They have access to service providers such as:

- Alliance Bernstein

- American Funds

- BlackRock

- Columbia Management

- Dodge & Cox

- Dreyfus

- DWS

- Federated

- Fidelity

- Franklin & Templeton

- Invesco

- Janus

- Inveso

- Janus

- John Hancock

- JP Morgan

- MFS

- Oppenheimer

- PIMCO

- T.Rowe Price

- Vanguard

Innovative Retirement Solutions is one of the National Plan Advisory Services dedicated exclusively to workplace retirement plans and those responsible for them.

Innovative Retirement Solutions’ crystal clear, flat-fee or fee-based service models that strive to allow employers to right-size the objective work they crave and trust the advice they’re given. Innovative Retirement Solutions helps improve workplace retirement plans by not selling anything

and instead supporting plan governance, retirement readiness, and other Advisor Partners. Visit www.InnovativeRetirement. net for more information.

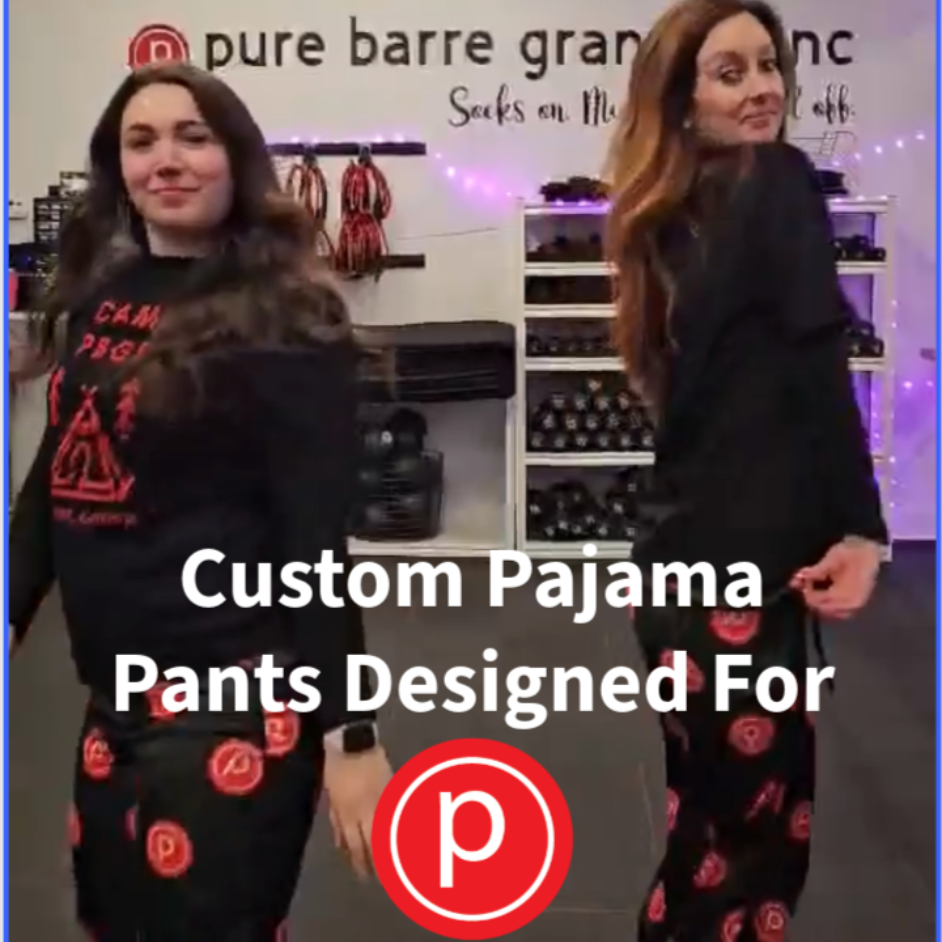

One of my favorite parts of what we do at Behind Your Design is taking an idea and turning it into something completely custom. For Pure Barre in Grand Blanc, we had the opportunity to design silky custom pajama pants for their instructors. We started with a custom pattern created in Adobe Illustrator, tailored specifically to reflect their brand. From there, we applied the design to a digital mockup and brought it to life in production. There’s something so satisfying about seeing a design go from a computer screen to a finished product and even better, seeing a team proudly wearing something made just for them. Custom pajama pants are just one example of the creative, outside-the-box branded apparel we can produce. If you’re looking for something different, memorable, and fully customized for your team or event, we’d love to design something just for you. Because custom hits different.

Canvas totes are having a moment. Thanks to Trader Joe's, what started as a simple grocery bagsare now widely recognized as stylish, everyday accessories that businesses are using to increase brand visibility. As Forbes notes, Trader Joe’s tote bags have become “an unlikely status symbol,” driven by scarcity, cultural cachet, and social signaling. Outside the U.S., owning one suggests access, travel, and a certain worldview, proving that “the object accrues value through scarcity.” That same psychology makes these bags especially effective as promotional products. Why we are paying attention and your brand should too: Canvas tote bags tap into perceived exclusivity Limited-feeling, small-format canvas totes come across as intentional and collectible, creating perceived value without a luxury price tag. Canvas totes act as social signals, not just swag A well-designed tote aligns your brand with style and lifestyle, not giveaways people forget at the bottom of a drawer. Their size encourages daily use Perfect for phones, wallets, keys, and small essentials, mini totes are easy to grab for errands, lunch runs, events, or travel. Canvas totes feel premium and practical Durable canvas, reinforced bases, sturdy handles, front stash pockets, and modern color options give these bags a retail-quality look. They align with modern brand values Reusable, PVC-free, and built to last, canvas totes naturally support sustainability and thoughtful branding. Mini canvas totes blend trend-driven psychology with everyday function. They give brands a stylish, affordable way to stay visible wherever life happens. At Behind Your Design , we believe the best promotional products are the ones people actually want to use. Mini canvas totes check every box: on-trend, functional, and easy to customize in a way that feels intentional, not overbranded. Whether you’re planning an event, creating client gifts, or building branded merchandise, we help you turn a simple bag into a lasting brand impression that shows up in everyday life.

Umbrellas may not be the first item that comes to mind for promotions, but they deliver impressive value when it comes to visibility, usefulness, and longevity. More than just rain gear, umbrellas offer year-round protection and everyday practicality, making them a promotional item people actually keep and use. Why umbrellas work as promotional items: Year-round usefulness – Provide rain coverage and help block harmful UV rays, adding a health-conscious benefit. High brand visibility – Large canopies create prime space for logos and messaging that can be seen from a distance. Repeated exposure – Stored in cars, offices, and bags, umbrellas are reused often, extending brand impressions. Wide audience appeal – Practical for all ages and lifestyles, making them ideal for diverse audiences. Long lifespan – Quality umbrellas can last for years, continuing to promote your brand long after distribution. Strong return on investment – Durable, useful items outperform smaller or disposable promotional products. Whether you go traditional or try something a little more fun, umbrellas remain a smart way to keep your brand visible rain or shine.